In 2018, we founded Dozens with an ambitious vision: to build a bank on an ethical business model – one where the balance sheet was aligned with customers’ needs.

Research showed that people in the UK weren’t making the most of their money. Many dipped into overdrafts, left cash in low-interest savings, or avoided investing altogether. Over time, poor planning and inflation quietly eroded their finances.

The problem was largely structural. No single institution was incentivised to look at a customer’s finances holistically.

High-street banks run competing balance sheets across retail and investing: they benefit when money sits in savings (to create loans) or when customers borrow. Fintechs emerged to challenge this, but most focused on a single slice of financial life to scale quickly.

So we set out to create a different model: a bank designed to align with customers’ interests and help them manage their entire financial life, end to end.

As Co-founder and CXO, I led product design, creative direction, and customer experience, while working closely with the leadership team on strategy, operations, and culture.

Helping people go from spender, to saver, to investor

Supporting them throughout their financial life

“In an increasingly competitive market, you'd better be a game-changing product if you're going to launch a new challenger bank. And that's just what Dozens is… a gamechanger"

— Startups100 Awards, 2019

Business Achievements

Secured two FCA licences. Launched our own financial product. Ran our own treasury, compliance and service teams. Processed £300m+ in customer transactions. Reduced fraud to 0.1%.

Built our own event-streaming, cloud-native core with seamless third-party orchestration, AI-ready data, and 99%+ uptime, with ~40% of costs recognised as R&D.

Embedded ethics into operating systems and decision-making. Became one of the first B-Corp-certified financial institutions in the UK. Protected the team through Covid and the Wirecard fallout. Later delivered the UK’s first solvent wind-down of a dual-licensed fintech in close collaboration with the FCA.

60,000

Brits started saving with Dozens

£3.6m

invested in our 5% bonds, helping our customers feel the benefit of earning interest

1 in 4

people who help bonds, went on to open their first investment product

A DEEPER DIVE

My personal journey with the business

Back towards the end of 2017, I was approached to be on the founding team of a startup.

There was no registered company, no office, and just a verbal promise of a small seed fund. But the idea was audacious: turn the banking model on its head and build a bank that grows when its customers do, rather than profiting when they struggle. Having seen how ordinary people paid the price for the 2008 financial crisis, I was motivated to help build a bank that genuinely worked in their interests.

Building a fintech from scratch is the biggest blank page I've ever been faced with

I joined bringing my background in advertising

Shaping the mission as a brand and ensuring that brand lived deep within the product and the business. My initial title was VP Storytelling (a title so “startup” I’ll never live it down with my friends).

Within a few weeks, I’d built an internal creative team

Across design, writing, illustration, and community management, and engaged external delivery partners.

I ensured my team became adept at navigating regulatory constraints

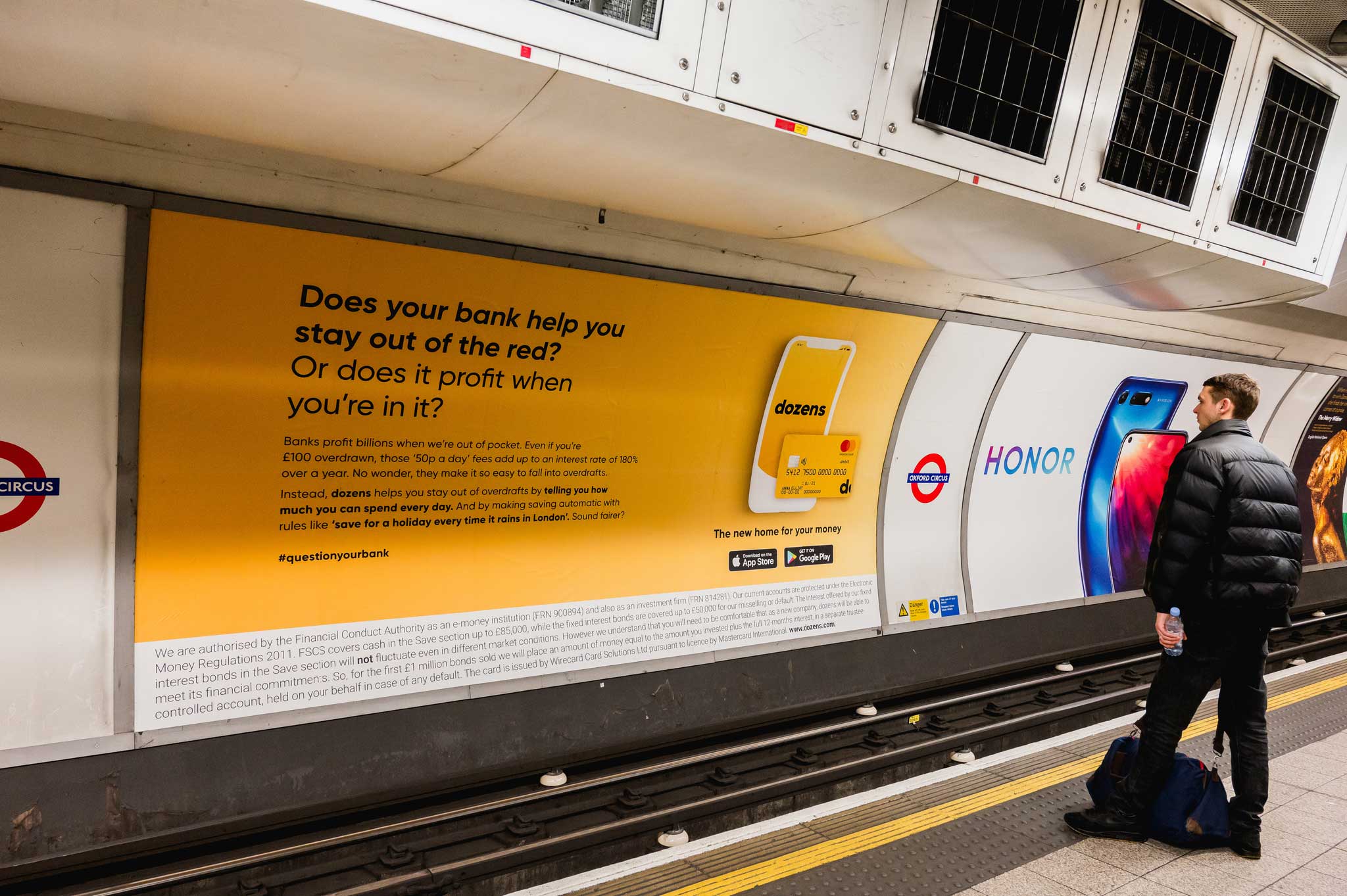

This meant we could deliver ideas at speed and work with limitations. For example, in 2018 before receiving our FCA licences, we couldn’t mention our offering publicly. Despite that, we launched a campaign gained attention to what we were doing by talking about the industry rather than ourselves. #QuestionYourBank was concepted, written, animated, and voiced entirely in-house, getting over 100k views and 5k waitlist signups to a service we weren’t even allowed to describe.

We continued to produce campaigns that challenged and punched above their weight/media budget, driving 120k downloads and a CAC of <£5 through rigorous testing.

#QuestionYourBank

We co-created with a 300-person community from across the UK

to understand real financial lives and shape the product and services with them. Over time, I built a range of research spaces. Alongside the #WeAreDozens community, we launched a pop-up branch with Westminster Council to explore what a bank could offer on a modern high street. We also toured the UK with The People’s Money Survey, gathering on-the-road insights that directly informed product and policy conversations inside the business.

I managed the customer comms ecosystem – website, onboarding, card packaging, and continuous engagement – maintaining regulatory records on financial promotions throughout. We turned moments of financial learning into relationship-building. Our education content increased understanding and uptake of new products, leading to $3.4m+ invested in our bonds, with one in four bond holders then going on to invest in ETFs

As my experience across product, tech, and the wider business grew, I took on the role of CXO and the product design remit with it.

I led the product strategy and design of Organix, our internal platform, and the 2.0 version of the Dozens app, while continuing to oversee improvements to the 1.0 version.

Throughout, as part of the leadership team, I set strategic direction and prioritisation, made hard calls, and navigated external shocks. I looked for ways to capitalise on our assets by productising our experience through Organix and Mojo. I raised funds by running our crowdfunding campaign (Seedrs’ biggest raise in 2019) and pitched in Hong Kong and the US.

I helped build a culture that made ethics part of the business rather than just marketing, through initiatives like our Values×Performance Matrix, transparent salaries and Yellow Card system. We ran regular company and team off-sites, social events, and open forums to sustain morale and connection, especially during difficult moments like Covid and the eventual wind-down.

When we decided to wind down the licence, I led the customer-facing communication strategy:

crafting clear, supportive messages, coordinating FAQs with compliance, and ensuring support channels were ready for customers seeking guidance. After operational closure, I worked with the leadership team to explore asset sales, partnership opportunities, and ways to preserve the most valuable parts of the platform and team.

Dozens was a deep experience of what it actually takes

to build from zero, and the day-to-day reality of running a high-stakes business.

Of holding customer trust, team livelihoods, and regulatory obligations simultaneously.

Of understanding that incentives compound – that product, culture, and governance are inseparable.

That leadership means accountability without full control.

Of living with the pressure revenue places on ethics – and having to make, defend, and stand by those choices in the interests of users.

And ultimately the emotional and cognitive load of long-term stewardship.

There are many things that will never make it into a case study or a LinkedIn post.

It was tough. Joyous. Heartbreaking and rewarding. All at the same time.

Would I do it all again?

For the right cause – of course.